Taiwan mobilises forces after China starts 'punishment' drills

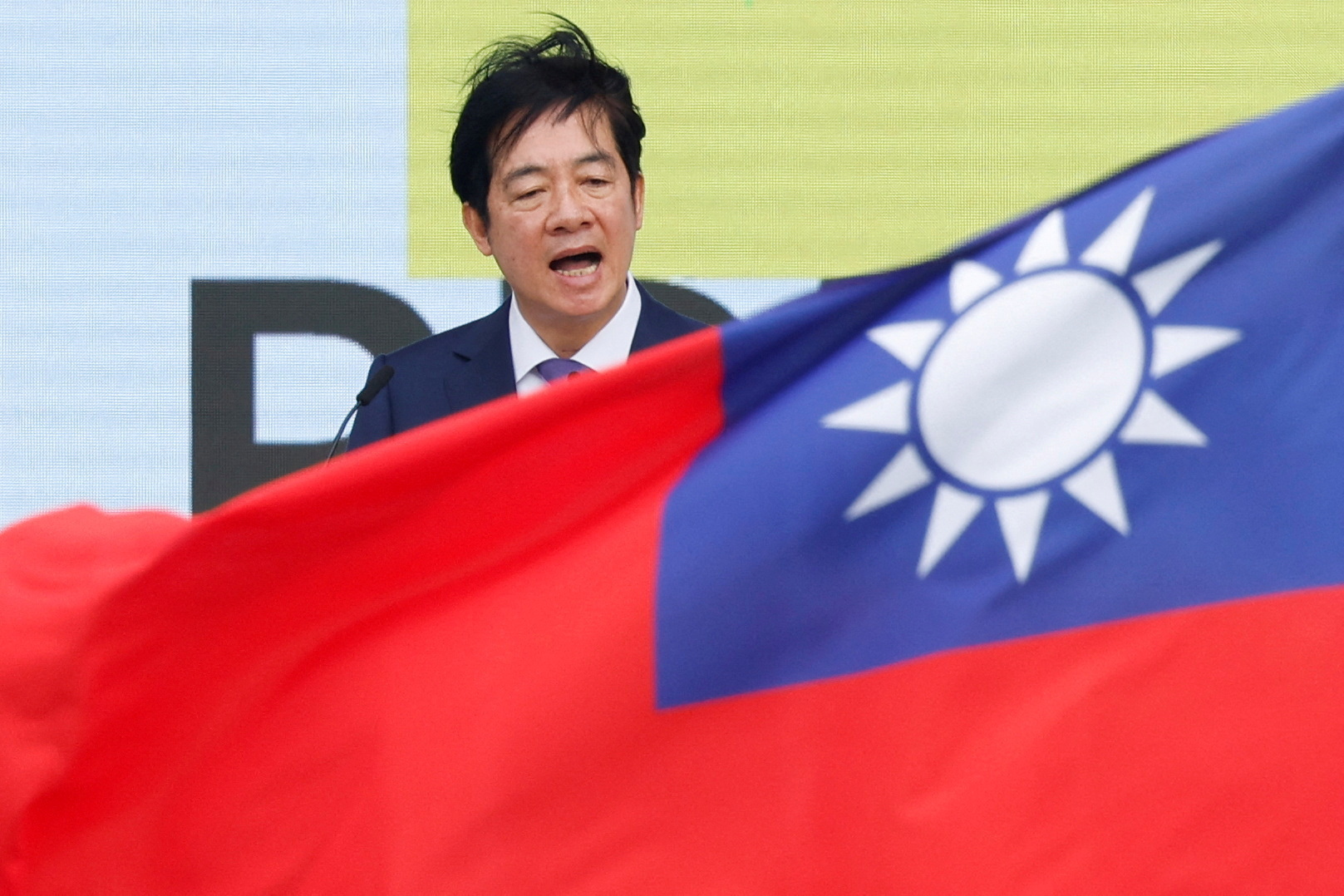

Taiwan's new President Lai Ching-te speaks on stage during the inauguration ceremony outside the Presidential office building in Taipei, Taiwan May 20, 2024. REUTERS/Carlos Garcia Rawlins/File Photo Taiwan's military mobilised its forces and said it was confident it could protect the island, after China started two days of "punishment" drills around Taiwan on Thursday in what it said was a response to "separatist acts".