The Proud Boys are back. Four years after the failed effort to overturn Trump’s 2020 electoral defeat, the violent all-male extremist group that led the storming of Congress on Jan. 6, 2021, is rebuilding and regaining strength.

[1/4]A member of the far-right Proud Boys stands for a portrait before a campaign rally for former U.S. president and Republican presidential candidate Donald Trump in Wildwood, New Jersey, May 11, 2024. REUTERS/Jim Urquhart

The Israeli military said another four Israeli hostages abducted by Hamas on Oct. 7 had died in captivity and that their bodies are being held by the Palestinian Islamist group.

Pictures of hostages kidnapped during the deadly October 7 attack by the Palestinian Islamist group Hamas from Gaza, are seen next to an Israeli flag on a building under construction, in Tel Aviv, Israel, May 31, 2024. REUTERS/Marko Djurica/File Photo - World

San Francisco police detained a group of pro-Palestinian demonstrators who entered the lobby of the building housing the Israeli consulate after they refused to leave, authorities said on Monday.

Markets

Mexico Election

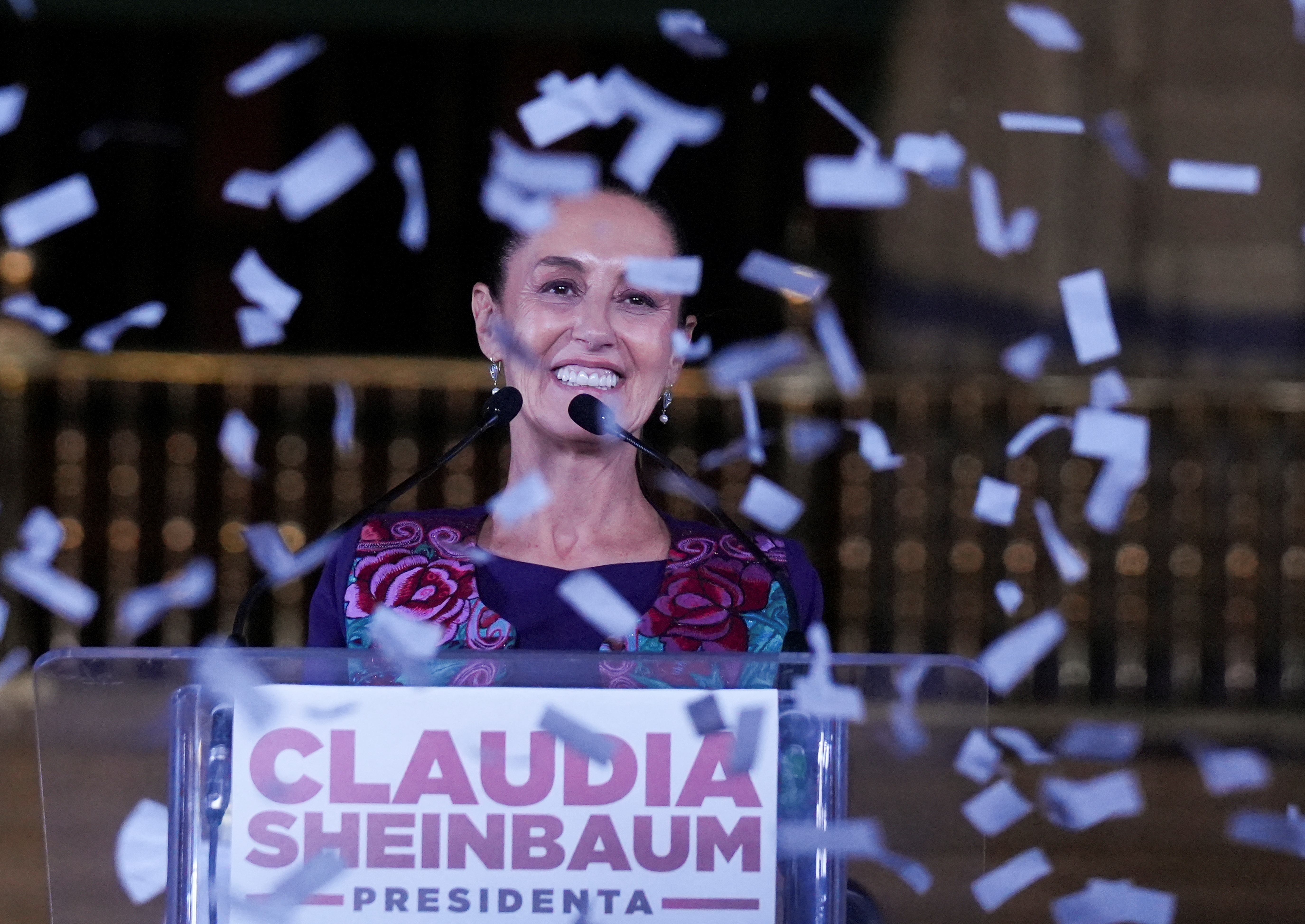

Claudia Sheinbaum basked in the glow of a thumping presidential win late Sunday, thanking supporters who gathered at the capital's iconic Zocalo plaza shortly after 1 a.m. to applaud Mexico's first female president.

Presidential candidate of the ruling Morena party Claudia Sheinbaum, reacts while addressing her supporters after winning the presidential election, at Zocalo Square in Mexico City, Mexico June 3. REUTERS/Alexandre Meneghini

Hunter Biden Trial

A jury was sworn in on Monday for the trial of Hunter Biden on gun charges, a historic criminal prosecution of a sitting president's son with the potential to influence the 2024 presidential election.

Hunter Biden, son of U.S. President Joe Biden, departs the federal court with his wife Melissa Cohen Biden, on the opening day of his trial on criminal gun charges in Wilmington, Delaware, U.S., June 3, 2024. REUTERS/Kevin Lamarque - Legal

Hunter Biden, the son of U.S. President Joe Biden, is scheduled to go on trial on June 3 in Delaware on charges he violated federal gun laws in 2018 when he purchased a firearm.

Defending champion Novak Djokovic produced a superhuman effort to subdue Argentine Francisco Cerundolo 6-1 5-7 3-6 7-5 6-3 on Monday and reach the quarter-finals of the French Open, as the top seed shrugged off a knee issue for a milestone win.

Tennis - French Open - Roland Garros, Paris, France - June 3, 2024 Serbia's Novak Djokovic reacts after falling during his fourth round match against Argentina's Francisco Cerundolo REUTERS/Yves Herman

President Emmanuel Macron has undertaken a crackdown on what he calls Islamist separatism and radical Islam in France following deadly jihadist attacks in recent years by foreign and homegrown militants

India's Prime Minister Narendra Modi is expected to win a record-equalling third consecutive term in office on Tuesday when the 642 million votes cast in the world's largest election are counted.

India's Prime Minister Narendra Modi greets supporters during a roadshow, ahead of the general elections, in Ghaziabad, India, April 6, 2024. REUTERS/Anushree Fadnavis/File Photo

Talking Points

As the local climate has heated up over decades, rivers and lakes have also shrunk.