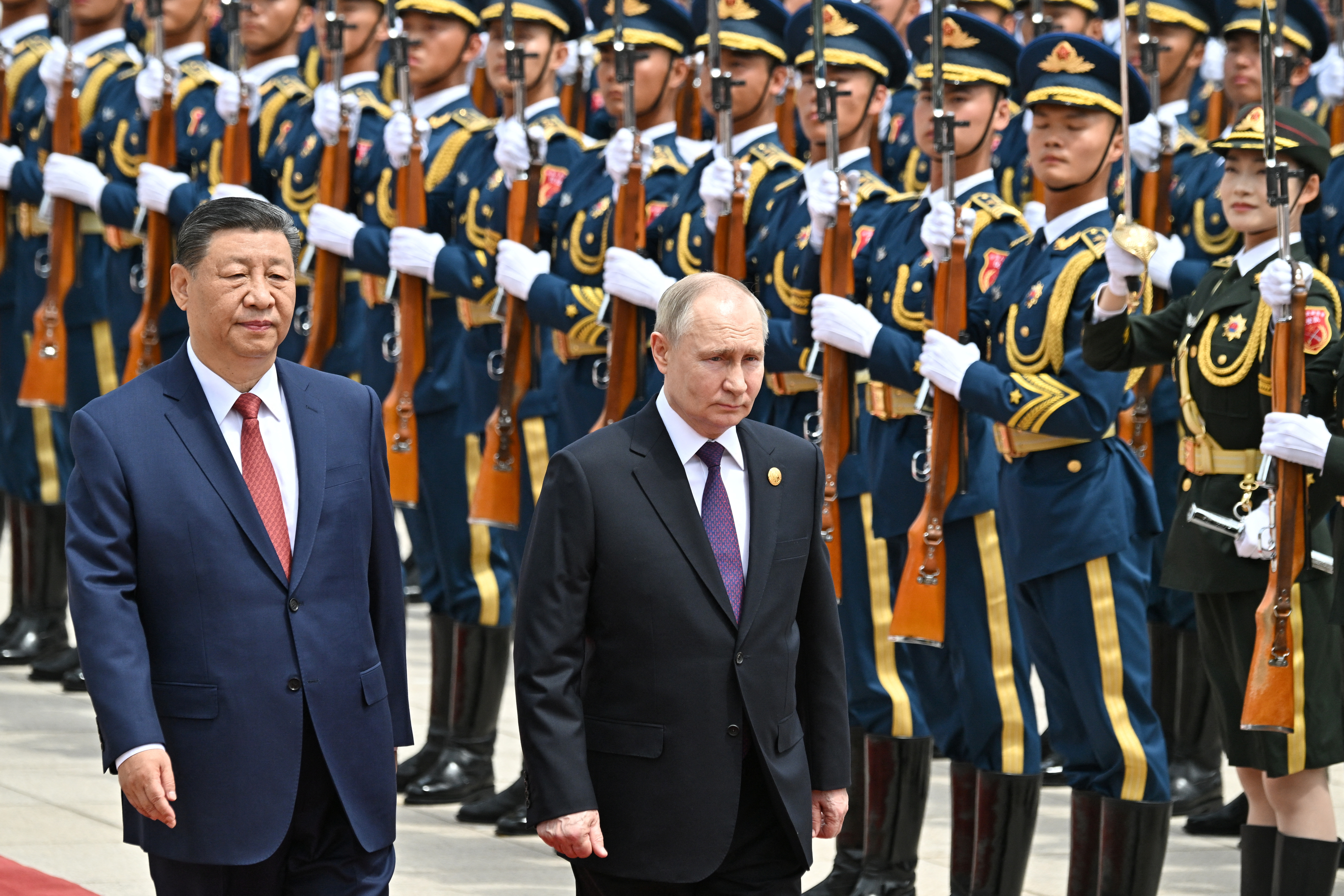

Xi lauds China-Russia ties as Putin arrives in Beijing

Russian President Vladimir Putin and Chinese President Xi Jinping attend an official welcoming ceremony in Beijing, China May 16, 2024. Sputnik/Sergei Bobylev/Pool via REUTERS Chinese President Xi Jinping pledged to work with counterpart Vladimir Putin to "rejuvenate" their countries as the pair started a day of talks in Beijing, saying China would "always be a good partner" of Russia, according to Chinese state media.

Markets

EnvironmentBrazil flooding will take weeks to subside, experts warn

Porto Alegre may suffer severe flooding for weeks, compounding the struggles of half a million people forced to abandon their inundated homes.